Tax season has a way of exposing small oversights that quietly add up. Many landlords assume they are claiming everything they can, only to realize later that missed deductions reduced their cash flow all year long. When margins are tight, overlooking a legitimate write-off can feel like leaving money on the table without ever noticing.

At HomeRiver Group, we work with rental property owners across multiple markets and see firsthand how bookkeeping, reporting, and tax planning intersect. Our experience managing properties at scale gives us a clear view of where deductions are commonly missed and how small details can significantly affect annual returns.

In this article, we break down rental property tax write-offs that landlords often overlook, explain why they are missed, and clarify how proper documentation and proactive management can help you keep more of what your property earns.

Understanding Allowable Rental Expenses

Navigating rental property tax write-offs means being clear about which expenses are actually deductible. The IRS designates a range of common operating expenses as allowable, but many property owners overlook line items that could significantly reduce year-end tax burdens. Having clarity upfront helps prevent missed deductions and improves overall tax planning accuracy, especially when reviewing rental property tax deductions.

Everyday Operating And Maintenance Costs

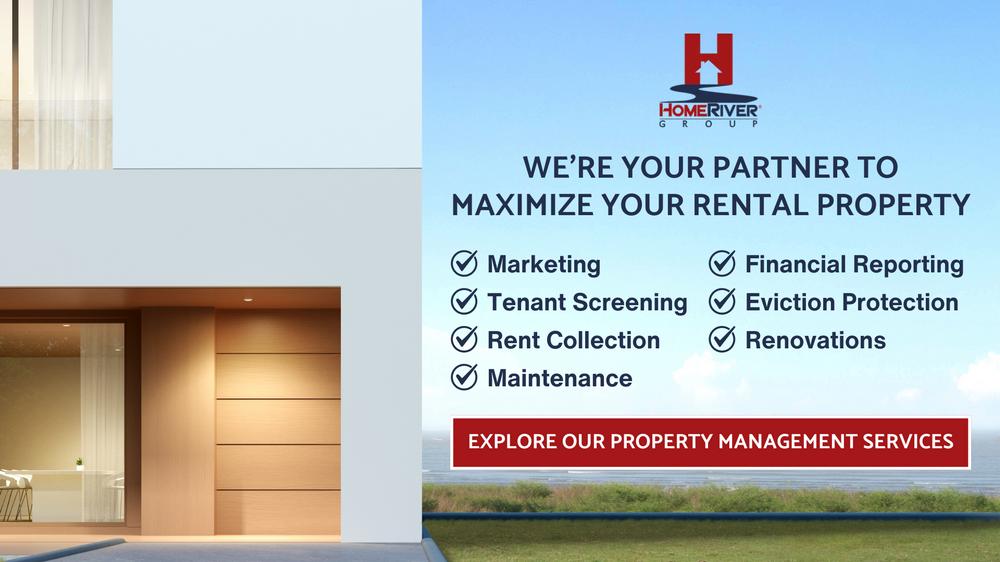

First, focus on the costs associated with the daily operation and upkeep of your rental property. This includes property management fees, routine repairs, advertising for tenants, and utilities you pay on behalf of renters. These expenses must be ordinary, necessary, and directly related to maintaining the property or supporting tenant occupancy, which is a core component of rental home tax deductions.

Loan Interest, Property Taxes, And Insurance

Interest paid on mortgages and property-specific loans is generally deductible, along with property taxes assessed by local authorities. Landlord insurance premiums also qualify as deductible expenses. They are often overlooked despite being a recurring and significant cost for property owners seeking to understand the full tax benefits of rental property.

Depreciation And Long-Term Asset Deductions

Depreciation is one of the most valuable deductions available to rental property owners. The building portion of your property, excluding land, can be depreciated over 27.5 years. Properly separating capital improvements from routine repairs is essential, particularly when evaluating: Can I deduct remodeling expenses for rental property?

Additional Allowable Expenses And Documentation

Other common write-offs include legal and professional fees, homeowners' association dues, pest control services, travel for property management purposes, and office supplies. Maintaining detailed records and receipts for all property-related expenses is critical, as only documented costs are deductible and defensible during an audit.

Maximizing Tax Benefits Through Proper Categorization

Identifying and correctly categorizing allowable rental expenses ensures you take full advantage of available tax benefits. Accurate classification supports compliance while optimizing deductions, ultimately improving the long-term return on your rental investment.

Hidden Opportunity In Startup Costs

Landlords leave valuable deductions on the table by overlooking the nuanced startup costs associated with bringing a rental property to market. These early-stage expenses include travel to evaluate potential investments, inspection and appraisal fees, and advertising efforts to attract qualified tenants before the first lease begins. Recognizing these costs early supports stronger tax planning.

Distinguishing Immediate Deductions From Capitalized Costs

The tax code differentiates between expenses that can be deducted immediately and those that must be amortized or depreciated over time. Major repairs completed before tenant occupancy are typically classified as improvements rather than routine repairs and must be depreciated over the property’s useful life. Careful classification is essential to maintain compliance and maximize deductions.

Accounting For Legal Fees And Prepaid Expenses

Non-refundable application fees, legal consultations during property setup, and prepaid insurance premiums may each have specific tax treatment. Maintaining detailed records ensures these expenses are allocated correctly and that each qualifying cost contributes to your overall tax strategy during the startup phase.

Separating Acquisition Costs From Operating Expenses

Many landlords overlook the distinction between acquisition-related costs, such as legal fees tied directly to purchasing the property, and deductible operational expenses. Understanding where these boundaries lie allows owners to claim allowable deductions upfront while spreading eligible costs over time for sustained tax benefits.

Turning Early Costs Into Long-Term Tax Advantages

Getting detailed with pre-rental expenditures can significantly impact tax outcomes. Properly categorizing and documenting startup costs helps convert early investments into long-term financial advantages, improving cash flow and strengthening the overall performance of your rental property portfolio.

Home Office Allocations For Landlords

Landlords often overlook the home office deduction, even though it can significantly affect rental property tax write-offs. If part of your primary residence is used regularly and exclusively for managing rental activities such as bookkeeping, tenant communication, and maintenance coordination, that portion of the home may qualify for a deduction.

Methods For Calculating The Home Office Deduction

Calculating this deduction requires either tracking actual expenses like utilities, insurance, and repairs, and applying the percentage of space used for business, or using the simplified method. The simplified option typically allows a set rate per square foot up to a defined limit, offering a more straightforward calculation with reduced administrative burden.

Documentation And Usage Requirements

The IRS requires that the home office space be used solely for rental-related tasks. Rooms with dual-purpose or occasional business use do not qualify. Maintaining accurate records, supporting diagrams, and consistent expense tracking helps ensure compliance and maximizes the benefit of this often-overlooked deduction.

Professional Service Fees You Can Claim

Professional service fees, often overlooked, can add up to meaningful tax deductions for rental property owners. Identifying these costs early helps ensure legitimate expenses tied to managing and protecting your investment are not missed during tax filing.

Eligible Professional Services And Advisory Fees

Fees paid to accountants, attorneys, property managers, and other qualified professionals for rental-related services are generally deductible. This includes tax preparation, legal guidance on landlord-tenant matters, compliance support, and ongoing property management services.

Bookkeeping, Consulting, And Inspection Costs

Routine bookkeeping, consulting services, and inspection fees directly connected to rental operations should be carefully tracked. Travel expenses incurred for meetings with these professionals, when primarily business-related, may also qualify as partial deductions.

Legal Documentation And Compliance Services

Expenses for drafting, reviewing, or updating lease agreements, eviction notices, and other compliance documents are deductible. These services support lawful operations and risk management, making accurate recordkeeping essential for substantiating claims.

Maximizing Deductions Through Detailed Records

Maintaining thorough documentation for all professional service invoices ensures deductions are captured accurately. These recurring expenses may seem minor individually, but can significantly reduce taxable income when tracked consistently over time.

Insurance Premiums That Qualify

Too often, rental property owners overlook the broad spectrum of insurance premiums eligible for tax write-offs. The IRS allows landlords to deduct most insurance premiums related to rental activity, which can significantly impact year-end profitability and overall cash flow.

Landlord Insurance Coverage And Deductions

Start with landlord insurance, specifically designed for rental properties and typically covering property damage, liability claims, and loss of rental income due to covered events. Premiums paid for landlord insurance policies are generally fully deductible from rental income.

Additional Property And Liability Coverage

Beyond standard landlord policies, other qualifying insurance premiums include fire, flood, and liability coverage. For properties in higher-risk areas, premiums for separate flood or earthquake policies are also deductible when directly tied to the rental property.

Umbrella Policies And Proportional Allocation

Umbrella insurance policies that provide additional liability protection above standard coverage are also deductible. When policies are bundled or cover both personal and rental assets, only the portion attributable to the rental property should be claimed to remain compliant.

Recordkeeping For Insurance Premium Deductions

Maintaining detailed records of insurance invoices and payment confirmations is essential. Organized documentation ensures accurate reporting, supports deductions during an audit, and contributes to more reliable tax filings and long-term portfolio management.

Recordkeeping Practices The IRS Expects

Accurate, thorough recordkeeping is essential for any landlord aiming to maximize rental property tax write-offs. The IRS scrutinizes every deduction, expecting landlords to maintain precise, contemporaneous documentation to substantiate claimed expenses, including clarity on whether you can deduct your own labor on rental property.

Organizing Records By Property & Tax Year: Use a dedicated recordkeeping system, digital or physical, organized by property and fiscal year. Store receipts for repairs, maintenance, supplies, and professional services so documentation is clearly labeled, complete, and easily retrievable.

Preserving Financial Proof Of Payments: Retain canceled checks, electronic bank statements, and credit card records, along with invoices. These documents establish a complete financial trail, demonstrating when expenses were incurred and paid, and their direct connection to rental property operations.

Tracking Mileage & Depreciation Records: Maintain separate mileage logs for rental property visits, noting dates, destinations, and purposes. For depreciation, keep settlement statements, mortgage documents, and records of improvements to support depreciation schedules and future capital gains calculations.

Storing Tenant & Vendor Documentation: Organize tenant communications covering leases, rent payments, and security deposits, along with vendor contracts and insurance policies. This documentation reinforces the legitimacy of deductions and demonstrates consistent, professional property management practices.

Final Thoughts

Savvy property owners know that every deduction matters come tax season. Overlooking crucial rental property tax write-offs can mean leaving profits on the table, while a strategic approach can drive long-term gains. Whether you’re managing a single-family home or multiple investment properties, careful documentation and a proactive mindset are essential in capturing every allowable expense.

At HomeRiver Group, we’ve seen firsthand how missed deductions, from depreciation to travel expenses, can impact owners’ bottom lines. Our national platform pairs centralized expertise with hands-on local insight to help you navigate the complexities of rental real estate. This means you stay informed about lesser-known write-offs while maintaining tight compliance and optimizing returns.

Tax laws evolve and can vary dramatically by location. Having a knowledgeable partner makes all the difference in ensuring you don’t miss opportunities for savings or fall behind on regulations. By taking a meticulous approach and working with experienced professionals, you turn rental property ownership into a more profitable venture.

When your focus is on maximizing value, HomeRiver Group stands ready to deliver exceptional service with local expertise. Your property is our priority, and so is making sure you benefit from every available rental property tax write-off.

Frequently Asked Questions About Rental Property Tax Write-Offs

What utility expenses can landlords deduct as write-offs?

Landlords can typically deduct utility expenses they pay for their rental property, including water, electricity, gas, trash collection, and sewer. If you cover utilities as part of your lease agreement, these costs become eligible for a tax write-off. However, if your tenants pay their own utility bills directly, you may not claim those amounts.

Can depreciation be claimed on appliances in a rental property?

Yes, landlords can claim depreciation on appliances provided in a rental property. Items like refrigerators, stoves, washers, and dryers are considered tangible personal property. Depreciation allows you to recover the cost of these items over their useful life, usually five years, reducing your taxable income.

Are travel expenses for managing rental property a write-off?

Reasonable travel expenses related to managing or maintaining your rental property are typically tax-deductible. This includes mileage, airfare, accommodation, and meals if you travel to collect rent, perform repairs, or oversee maintenance. It’s important to keep detailed records and receipts to support these deductions.

Can landlords deduct legal and professional service fees?

Legal and professional service fees are valid rental property tax write-offs. Fees paid to attorneys, accountants, or property management professionals for services related to your rental activity can be fully deducted as business expenses.

What insurance premiums are tax-deductible for landlords?

Insurance premiums you pay to protect your rental property are generally tax-deductible. This includes landlord liability insurance, property insurance, fire/casualty coverage, and flood insurance. If you have an umbrella policy or rider specifically for the rental, those premiums also count.

Can landlords write off advertising expenses for finding tenants?

Advertising costs for finding new tenants are legitimate tax write-offs. This covers online ads, newspaper listings, signage, and agent fees directly related to marketing your rental property. Always retain receipts or invoices as supporting documentation.

Can repairs and maintenance costs be written off?

Repairs and maintenance expenses that keep your rental property in good working condition are fully deductible in the year incurred. This includes things like fixing a leak, painting, or replacing broken doors or windows. Improvements or upgrades, however, are not immediately deductible and must be capitalized.

Are property management fees tax-deductible?

Yes, property management fees are tax-deductible. Fees paid to a professional property management company like HomeRiver Group for handling leasing, maintenance coordination, accounting, and other services related to your rental property reduce your rental income for tax purposes.